Post #BankingRC, public trust will only 'trickle down' from Government action

When it comes to boardroom buzzword bingo, in 2019, the winner is "trust".

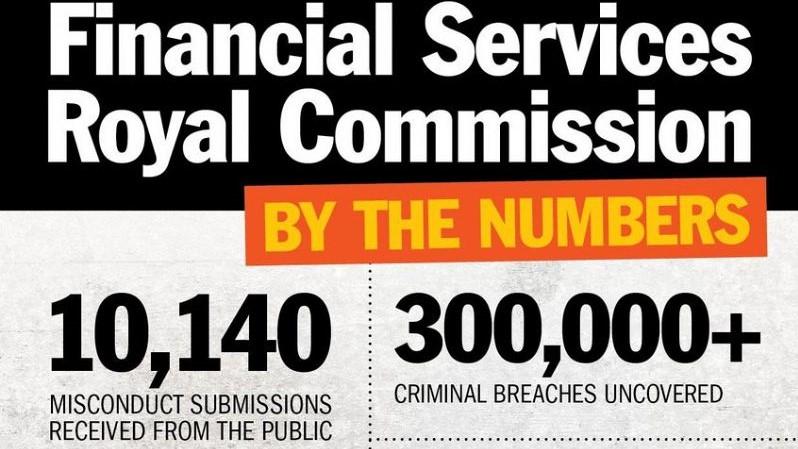

It started darkly. The banks were firmly in the frame when their integrity was questioned at its core by the Financial Services Royal Commission.

In early February, the official response from Canberra started the ball rolling.

According to the Government press release:

'The Government’s principal focus is on restoring trust in our financial system.’

March Australia Melb@marchmelb

With the release of the Banking Royal Commission report, it seems the banks have come out unscathed due to political protection, writes John Passant.... https://independentaustralia.net/life/life-display/banking-royal-commission-business-as-usual-for-the-big-four,12348 …

Banking Royal Commission: Business as usual for the Big Four

independentaustralia.net

See March Australia Melb's other Tweets

Shock waves rippled through corporate Australia as nervous CEOs ran scared that they would be tarred by the brush blackening the name of their banking cousins.

“Organisations are asking themselves fundamental questions about their purpose, their culture and how they present themselves to the world”, pronounced KPMG Chair Alison Kitchen as the Commission’s findings had begun to filter out.

Counsel to the top end of town, PricewaterhouseCoopers (PwC), warns of a trust crisis. When trust in an organisation is broken, they advise, then 'the value of that organisation being eroded'.

If PwC’s statement is anything to go by, Corporate Australia is side-stepping the real issues. It started as a public demand for corporate boards and executives to take responsibility for deliberate acts of deception, lawlessness, greed and unfairness. A few short months later, it’s mutated into being about how to exploit trust to maximise corporate value.

Maybe there are still some people who hold onto the belief that maximising profitability is the best thing corporations can do to be socially responsible. The idea that unleashing free enterprise and the power of the markets will lead to general prosperity is at the heart of the neoliberal ideology that has dominated the public imagination since at least the 1980s.

But there comes a time when long-held beliefs that have been persistently proved incorrect need to be discarded. In Australia, the fortnightly pay packet of the top one per cent of income earners is as much as the bottom five per cent receives in one year. CEOs are very much a part of this. Executive pay is at record highs while there seems no end to endemic wage stagnation.

Trust in corporations is not a commercial issue, it is a political one. Looking to CEOs as the heroes to solve the problem is just playing a myth that should have long ago been discredited.

When will Scott Morrison apologise to the Australian people for voting against a Banking Royal Commission 26 times and schedule extra sitting weeks in the Parliament to work with Labor to clean up the banks?

804 people are talking about this

Will the Royal Commission just be reframed as an opportunity to build corporate value? At this rate, it seems so. Public relations and marketing firm, Edelman, urges corporates to engage their services so that they can

'... manage its trust capital among its audiences, stakeholders and shareholders.'

Economics for Dummies defines capital as 'machines, factories and infrastructure used to produce output'. That sums up the sophistication of economic thinking and brutal self-interest seeking at play.

The trust of Australian’s citizens is regarded by corporations as a resource to be owned and exploited in order to produce output. In this case, output in the form of increased corporate value — value that trickles down no further than the executive pay packet.

Prime Minster Scott Morrison agrees:

“The need to restore trust with customers, employees, suppliers and the wider community is preoccupying boardrooms across Australia, not least because trust enables efficient trade and commerce by allowing markets to function better.”

The way things are going, corporate culture, as propped up by conservative politicians and neoliberal ideologues, will barely change as a result of the Royal Commission. Manufactured trust is no substitute for political action.

Our capacity for real change will only be stifled if we all suddenly get charmed by sweet talk of "trust" and "integrity". Instead, there is a democratic necessity of people and institutions to continue to challenge the political and economic system in which we find ourselves.

Very strange for a #politician , even (or perhaps especially) @ScottMorrisonMP to be lecturing business about the need to rebuild trust. Maybe it should be tried in the political sphere first... https://theconversation.com/rebuilding-trust-is-vital-morrison-to-tell-business-112877 … #auspol

Rebuilding trust is vital, Morrison to tell business

theconversation.com

See Alison Jones's other Tweets

Carl Rhodes is Professor of Organisation Studies at the University of Technology, Sydney. You can follow him on Twitter @ProfCarlRhodes.

This opinion piece was first published on Independent Australia.