Image: Pixabay

It used to be that when consumers felt pessimistic about their economic future they would save more, and when they felt positive their wallets and credit cards would come out. But UTS Industry Professor Warren Hogan says that’s no longer true - while consumers are not terribly optimistic at the moment they are still spending.

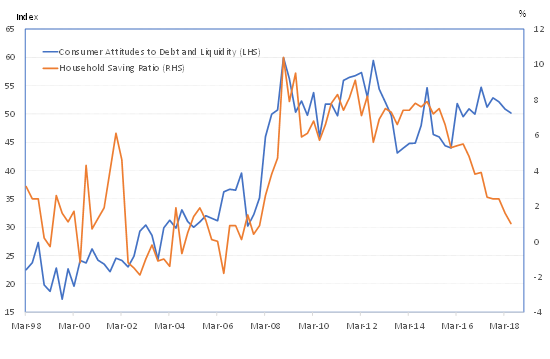

“The household net saving rate is only 1% and heading towards zero – but surveys asking people about their outlook for the next 12 months are telling us that Australian consumers are quite concerned,” Professor Hogan says.

In September, the Melbourne Institute and Westpac Bank Consumer Sentiment Index dropped 3% to 100.5, only just in positive territory. Sentiment among households with a mortgage fell 5.6%.

Professor Hogan, former ANZ Chief Economist, is currently working with researchers at UTS Business School to gain a deeper understanding of the complex dynamic between consumer sentiment and saving so we can better predict where the economy is headed.

“The drivers of the savings rate are related to consumer perceptions around wealth, long-term risk and income growth. Some of these things are quite difficult to measure, but we’re making some headway,” he says.

While most economic reports, such as gross domestic product (GDP), tell us where the economy has been, consumer confidence is important because it can signal the future direction of the economy. Historically it has been a particularly accurate indicator of economic downturns.

“When we think of economic growth, we think of industries such as mining, construction or agriculture as fuelling the fire, but the real workhorse of the economy is the consumer,” Professor Hogan says. “Consumer spending makes up half to two-thirds of measured economic activity.”

“If confidence falls this could lead to lower spending, as consumers save for perceived rainy days ahead. This reduces the rate of economic growth, which can then become a self-fulfilling negative spiral if central banks and governments don’t intervene,” he says.

“When equity markets fell 20 to 30 per cent during the 2008 global financial crisis this really scared consumers. There was a big increase in the saving rate, driven largely by a decline in consumer spending growth.

“The household saving ratio rose to a near 30-year high at just under 10%. It then hovered around 8% for the next six or seven years before falling in the last few years. It’s currently only 1%, a rate not seen since before the GFC.”

Professor Hogan says the unusual situation we have now, where consumers are not terribly optimistic but are still spending rather than saving, is due to low wage growth. Real wages have struggled to rise in recent years, but spending is ‘sticky’ – particularly for essentials such as food, housing and utilities.

“What we’re seeing is that consumers are cautious but they’re running down their rate of saving because they’re trying to maintain a standard of living.”

However, this may not last. “In the absence of a pick-up in income growth, consumers may reassess spending plans and rebuild saving at a pace consistent with the caution seen in sentiment surveys,” Professor Hogan says. “There’s certainly a broad view that this isn’t sustainable. At some point, consumers will adjust.”

Consumer Caution and Household Saving. Source: Westpac-Melbourne Institute, ABS and UTS Business School

Along with low wage growth, Australians have another burden that’s probably playing on their minds – a substantial amount of household sector debt. Australia now has one of the most indebted household sectors in the world.

“Australia’s household debt to income ratio is about 190 per cent. In the US during the subprime crisis the household debt to income ratio only got up to around 120-130 per cent. There’s no universal tipping point for household debt, so it’s difficult to identify the levels where something goes wrong,” Professor Hogan says.

Rises or falls in house prices and the stock market impact how consumers feel, particularly if they believe their wealth is significantly increasing or decreasing. With house prices declining in many areas around Australia, this will play into the consumer sentiment story.

“People will look through small blips in house prices because it is a long-term asset. But if it plays out for long enough or the size of the move is big enough, that will start to force people to reassess their financial position,” Professor Hogan says.

“This is what we need to be watching for the direction of the economy over the next six months – how our heavily indebted household sector responds to this economic environment.”

Hopefully they pull out the umbrella, rather than battening down the hatches.