With the material impacts of climate change becoming increasingly apparent across the global economy, and with Australia committing to net-zero emissions by 2050, there is a need to ensure that those working across the financial system have the skills required to support an orderly transition of the Australian economy.

ISF, in partnership with CSIRO Climate Science Centre undertook a national ‘Climate Skills Survey’ of finance professionals to understand the level of skills across Australia’s financial system.

The survey looked at the current level of climate skills, defined as climate/climate risk-related skills, knowledge areas or competencies, in relation to existing market demand and explored barriers to increasing skills. It also investigated mechanisms that could provide the necessary upskilling.

The key conclusion from the survey is that there is currently a climate skills gap and that this gap is likely to grow unless urgent action is taken.

The range of functions where climate-related and sustainable finance skills are required is diverse, from accounting through to risk management and assessment of investment opportunities. Failure to address the skills gap could impede the rapid, economy-wide decarbonisation and reallocation of capital needed to meet net zero emissions targets.

The results of the survey are published in the report, Advancing climate skills in the Australian Finance System.

The specialisation of skills/knowledge required for this area has moved very quickly and there are not enough people who have experience of both climate and the finance sector.

– Climate Skills Survey participant

Demand is clearly outstripping supply

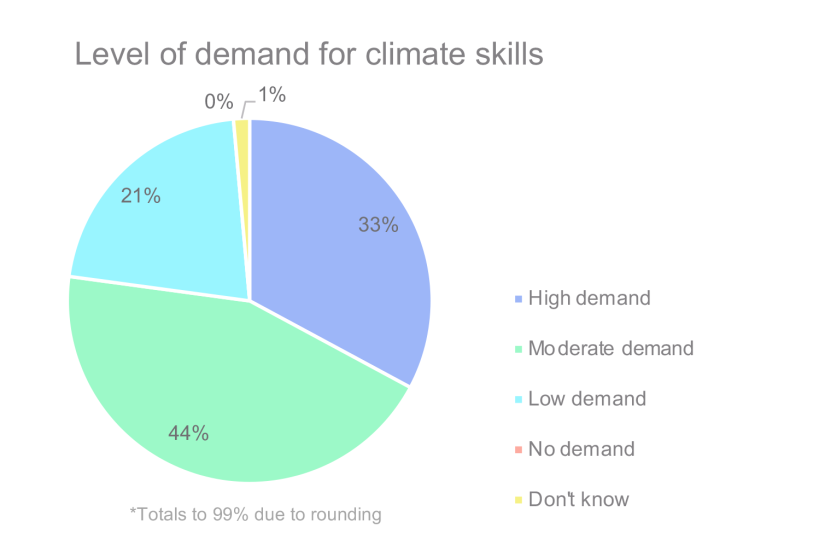

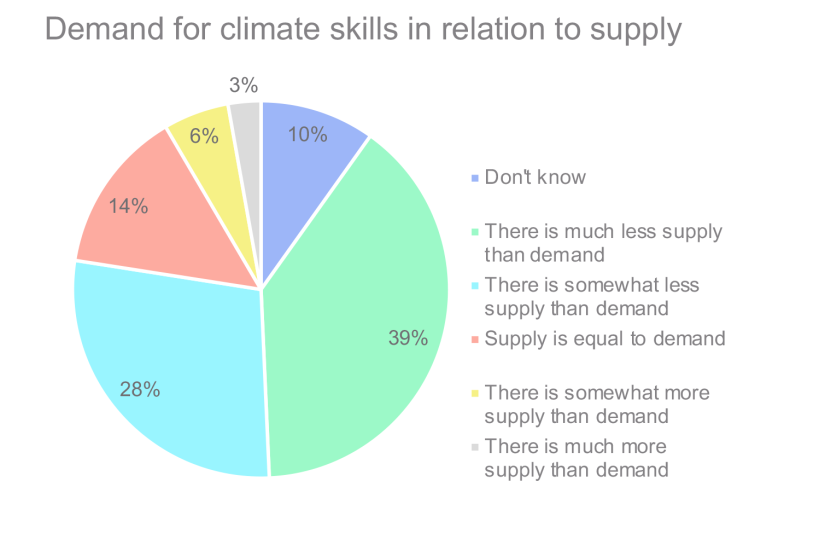

More than three-quarters of survey respondents said that climate skills are in moderate to high demand in their organisation, yet 39% of respondents said that there is much less supply than demand.

As one participant noted, “The specialisation of skills/knowledge required for this area has moved very quickly and there are not enough people who have experience of both climate and the finance sector.”

So, what's preventing finance professionals from having relevant climate skills?

Financial system participants face a number of challenges to integrating climate skills into their practice.

Chief among them is time. As one participant remarked, "Every single person I work with is short of time. Like never before. Skills development and training is a luxury which is easy to ignore.”

An additional challenge is the rate at which sustainable finance skills requirements are changing. Skills will need to be constantly updated to reflect evolving management and regulatory practices. The continued evolution of climate science and the need to reallocate capital to sustainable activities makes integration difficult.

And finally, because this is an evolving area, there is no system-wide coordination or standard in practice.

How do we address the problem?

Australia must establish a 'sustainable finance learning ecosystem' that supports regular structured learning, and generation of new knowledge.

Two key mechanisms are proposed:

1. Sustainable Finance Skills Partnership

The report recommends a Sustainable Financial Skills Partnership between industry, government, regulators, universities, researchers and other professional finance training providers. The Partnership could be led by a consortium consisting of the Australian Government, industry, academia and research institutions and would provide a pltform for collaboration across Australia’s financial system on sustainable finance skills.

2. Australian Sustainable Finance Skills Report

There is a need for development of an annual Australian Sustainable Finance Skills Report to understand the current state of play, track the strategic development of sustainable finance skills and competencies over time, and benchmark performance internationally.

Taking this action in the short term will mean strengthen Australia's finance system to meet the challenges of the future, and will bring Australia into line with international best practice.

RESEARCH OUTPUTS

Advancing climate skills in the Australian finance system (2022) (Report)

Researchers

-

Gordon NobleResearch Director

Gordon NobleResearch Director -

Program Lead - Business, Economy And Governance

-

Senior Research Consultant

Year

- 2022

Location

- Australia

Client

- Commonwealth Scientific and Industrial Research Organisation (CSIRO)