Image: Alpha Stock Images cc

The productivity commission has found that competition is limited in financial products such as home loans, bank payments and insurance, which implies higher costs to consumers.

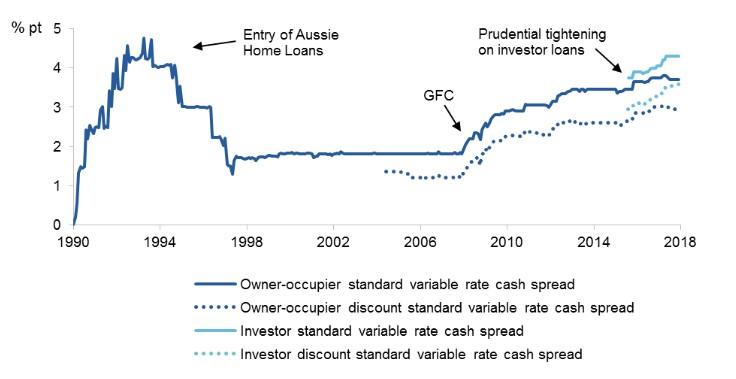

The following chart shows the rate spread between home loans and the RBA cash target rate published by the productivity commission.

The figure suggests that the consumers pay (in excess of the cash target rate) a greater price today than in the last twenty years. Surprisingly or not, this increase went largely unnoticed as the increase coincided with a decrease in interest rates.

Is this the price of financial stability?

While there may be many reasons, two stand out: first, post the Global Financial Crisis, regulation of the finance industry has been substantially increased and banks have passed on these costs to consumers, despite the limited impact of the crisis in Australia.

There were a number of major global regulation changes for banks like Basel II.5 and Basel III and more recently limits on interest-only lending to 30% of new residential mortgage lending in 2017, and the bank levy. These changes have made it more costly for banks to lend and these costs have been passed on to consumers. However there is also a second reason - Australia has failed to establish a more competitive financial system and this is what the productivity commission is tasked to change.

The draft report says: “Internationally, Australia’s banking concentration is on par with that of Canada and the Netherlands, but well above that of the United Kingdom, United States and Japan.” It is apparent that larger systems are able to accommodate a greater number of bank players. Banking markets are global and in order to access global financial markets banks need to be a minimum size. Note that internationally the Australians banks are considered domestic but not global systemically important banks. Australia’s big four banks have a market share greater than 80% for a range of financial services, and home loans dominate other product classes by far.

Ways out?

While substantial growth in Australia is limited in the short-term, the commission points out a number of aspects that would increase bank competition. Prudential regulators should limit preferential treatment of so called IRB banks, which have substantially lower risk weights than standardised banks. IRB banks estimate their own risk models which indicate low risk weights as Australia has not experienced any major downturns since the collection of loan default data. The Basel III risk weights for standardised banks are much greater as they have been calibrated to consider past global economic downturns.

As well as a harmonisation of regulation across lenders, the commission calls for a finer delineation of regulation based on bank risks that in turn leads to more granular product pricing

Mortgage brokers are seen as a way to increase competition as they may consider smaller lenders. However, the commission notes that mortgage brokers do not have to serve the best interest of consumers, they benefit from trailing fees, and are owned by lenders in some instances. So changes are needed to make mortgage broking a market place in which small and large lenders can compete by price and not size.

The commission calls for a more favourable environment to make it easier for consumers to shift to a preferred provider by reducing change fees such as mortgage registry fees, the promotion of consumer literacy for better comparison of financial products, and de-bundling of service offerings. An example for de-bundling would be the separation of a checking account and credit card from a home loan. However, bundles may remain where they create consumer value such as the offering of offset accounts together with home loans to reduce the tax burden.

What can the government do?

The commission calls for a continuing body to oversee these changes and monitor competition. The body should be established within the Australian Securities and Investment Commission, which is already part of the Council of Financial Regulators (next to APRA and the RBA) or the Australian Consumer and Competition Commission. APRA and the RBA are seen as not fit to do the job as it may conflict with their current mandate to ensure financial stability

An important aspect to consider is the production costs of financial service providers. Funding and infrastructure costs are to a great degree fixed and larger banks benefit from transferring these to a greater number of customers. New Fintech solutions may focus on pooling the interests of smaller providers or alternatively government may offer suitable platforms should the industry be unable to produce these.