Need help at tax time?

UTS has combined resources with the ATO Tax Help Program to offer a qualified service to students and staff to assist with their Individual Tax Returns.

We provide on-campus in-person appointments from Monday 28 July 2025 to 31 October 2025. To request a booking, call SSU reception on 9514 1177 from Wednesday 23 July 2025.

Note the following:

- you are required to lodge your tax returns by 31 October 2024. You can do this through the Tax Help Program

- check your eligibility to access the free services, below

- prepare the documents you will need the appointment

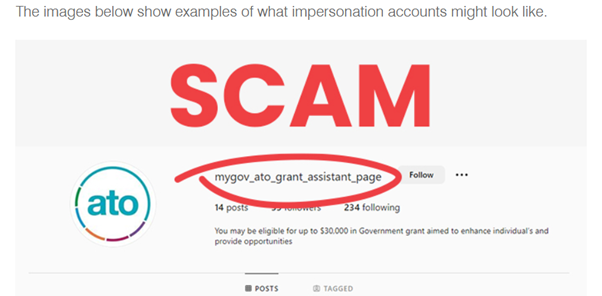

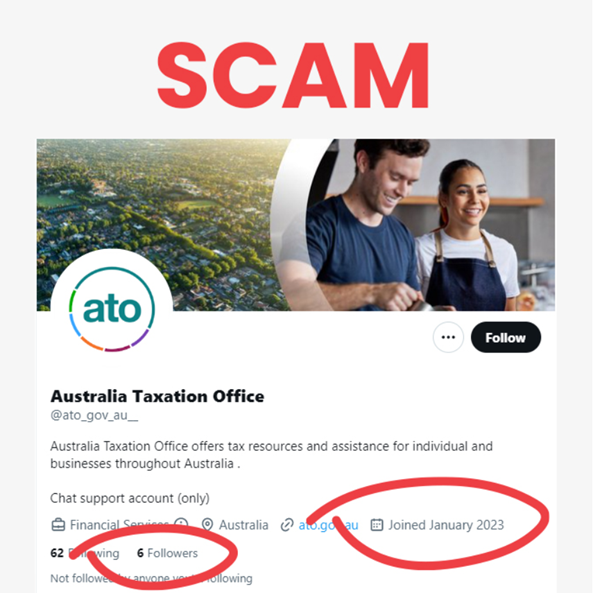

- be vigilant of a SCAM. The current 2024 SCAMs are shown on the ATO website

Australia is seeing an increase in fake social media accounts impersonating the ATO. See what they look like and how to identify these social media account as fake.

Also be aware of the scam that tells people their 'tax lodgement' has been received. The email asks them to open an attachment to sign a document and complete their 'to do list details'. If you get an email like this, don't click on any links or open any attachments - forward the email to ReportEmailFraud@ato.gov.au and then delete it.

You need to know this about the Tax Help Progam

Tax Help Program volunteers are trained and accredited by the Australian Tax Office and can:

- help you submit your current tax PAYG return

- show you how to submit your own tax returns for future years

- advise if a tax return is necessary in your case. You can speak to one of our volunteers about non-lodgement (In some cases, low income earners do not need to lodge a tax return. If it is not necessary, and you lodged a return last year, it is important for the ATO to know this).

Tax Help can’t help you with:

- business tax returns

- partnership and trust matters

- capital gains tax

- rental property tax income schedules

Who's eligible?

The ATO Tax Help Centre is open to UTS staff and students, who

- have earned around $60,000 or less for the tax year and who

- have income earnings from employer salaries (PAYE); interest and dividends. This excludes income from ABN contracts and other tax schedules.

You are eligible to access the service if you are:

- an international student*

- an Australian citizen

- a permanent resident

- on any work-permitting visa or humanitarian visa;

- Note: UTS College students can use the external ATO Tax Help Centre services listed above

*Overseas students who are temporary residents and enrolled in a course that is more than six-months long are generally taxed as an Australian Resident. If you are leaving Australia permanently, you can lodge your tax return with the ATO before the end of the financial year (30 June) and can apply for the repayment of any superannuation contributions made by your employer. Temporary residents should complete the 'Departing Australia Superannuation Payment' (DASP) (opens external site) with the ATO to reclaim their superannuation contributions.

And your income was received through:

- salary or wages as an employee, casual, part-time or full-time

- Australian government benefits and allowances, such as unemployment, Youth Allowance, Aus/Abstudy or sickness benefits

- pensions

- dividends

- managed funds

- interest

If in doubt, please refer to the ATO Tax Help Centre![]() Client Eligibility Flowchart (PDF 63KB, one page).

Client Eligibility Flowchart (PDF 63KB, one page).

Book an appointment

Bookings for the UTS Tax Help Centre will start scheduling appointments on 1 August 2024 for 5 August to 31 October 2024. Please call Student Service Reception on 9514 1177. Bookings close on 25 October 2024 or prior if all appointment options have been filled.

What documents do I bring to my appointment with a Tax Help Service?

To prepare your tax return, you must bring:

- your tax file number

- your BSB and bank account details

Local students/staff:

- your Medicare card or number & private health insurance statement where applicable

International students/staff:

- your OSHC private/Medibank health insurance

Further relevant information as itemised (PDF 62KB, one page) to the appointment.

Also:

To lodge your tax return you are required to set up a myGov account (opens external site). If you have not already registered your personal online myGov account, we will assist you.

Please link your ATO account in myGov before you attend your appointment.

Please bring the following:

- Your Tax File Number

- A valid, personal email address

- Your myGov log-on for the ATO portal, if already set up

AND

Provide any 2 items of the following documents which will enable the link between your myGov account to your ATO service:

- Your Bank account details (if you have received a bank transfer from a previous tax return to this account)

- Your Superannuation account details (one from the last 5 years)

- Your PAYG Payment Summary (one from the last 2 years)

If you are unable to bring two of the above requirements, then please bring

- Your passport

Other tax help centres

Here are some volunteer organisations that can help with tax close to the UTS City campus. You’ll need to contact the organization and make an appointment.

| Who and Where | Contact details |

|---|---|

| Tanya Plibersek MP Offices 150 Broadway, Chippendale | 9379 0700 |

| Australian Chinese Community Association Rockdale Centre, 452 Princess Highway, Rockdale 6 Bridge Street, Granville | 9597 5455 9637 9913 |

| City of Sydney, Glebe Neighbourhood Centre Glebe Town Hall, 160 St Johns Rd, Glebe | 9298 3187 |

| Walla Mulla Community Centre 49 McElhorne Street, Woolloomooloo | 9368 1381 |

| Newton Neighbourhood Centre 1 Bedford Street, Newtown | 9516 4755 |

Self help: Lodge your own tax return online

To lodge your own tax return, use the official Tax Office online preparation and lodgement software, myGov (opens an external site).

However:

The ATO offers an alternative service including Virtual Tax Help, Tax Help by phone and Tax Clinics available to eligible taxpayers. Call the general enquiries number - 13 28 61 for further assistance.

*Overseas students who are temporary residents and enrolled in a course that is more than six-months long are generally taxed as an Australian Resident. If you are leaving Australia permanently, you can lodge your tax return with the ATO before the end of the financial year (30 June) and can apply for the repayment of any superannuation contributions made by your employer. Temporary residents should complete the 'Departing Australia Superannuation Payment' (DASP) (opens external site) with the ATO to reclaim their superannuation contributions.